Roth Ira Contribution Deadline 2025 - For the 2025 tax year, married individuals filing jointly with a modified adjusted gross income. However, keep in mind that your eligibility to contribute to a roth ira is based on your income level. If you have a traditional ira, a roth ira―or both―the maximum combined amount you may contribute annually across all your iras is the same:

For the 2025 tax year, married individuals filing jointly with a modified adjusted gross income. However, keep in mind that your eligibility to contribute to a roth ira is based on your income level.

2025 Max Ira Tina Adeline, For individuals under the age of 50 in 2025, the maximum roth ira contribution limit is $7,000. Less than $146,000 if you are a single filer.

Backdoor Roth Ira Contribution Limits 2025 2025 Terra Rochelle, For individuals under the age of 50 in 2025, the maximum roth ira contribution limit is $7,000. The maximum contribution limit for roth and traditional iras for 2025 is:

Deadline To Contribute To Roth Ira For 2025 Berry Celinda, In any given year, the ira contribution deadline is the same as the tax return filing deadline. If you have a traditional ira, a roth ira―or both―the maximum combined amount you may contribute annually across all your iras is the same:

Roth IRA Contribution Limit 2025 2025 Roth IRA Contribution Limits in, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. The deadline to contribute is tax day for the year you're making the contribution.

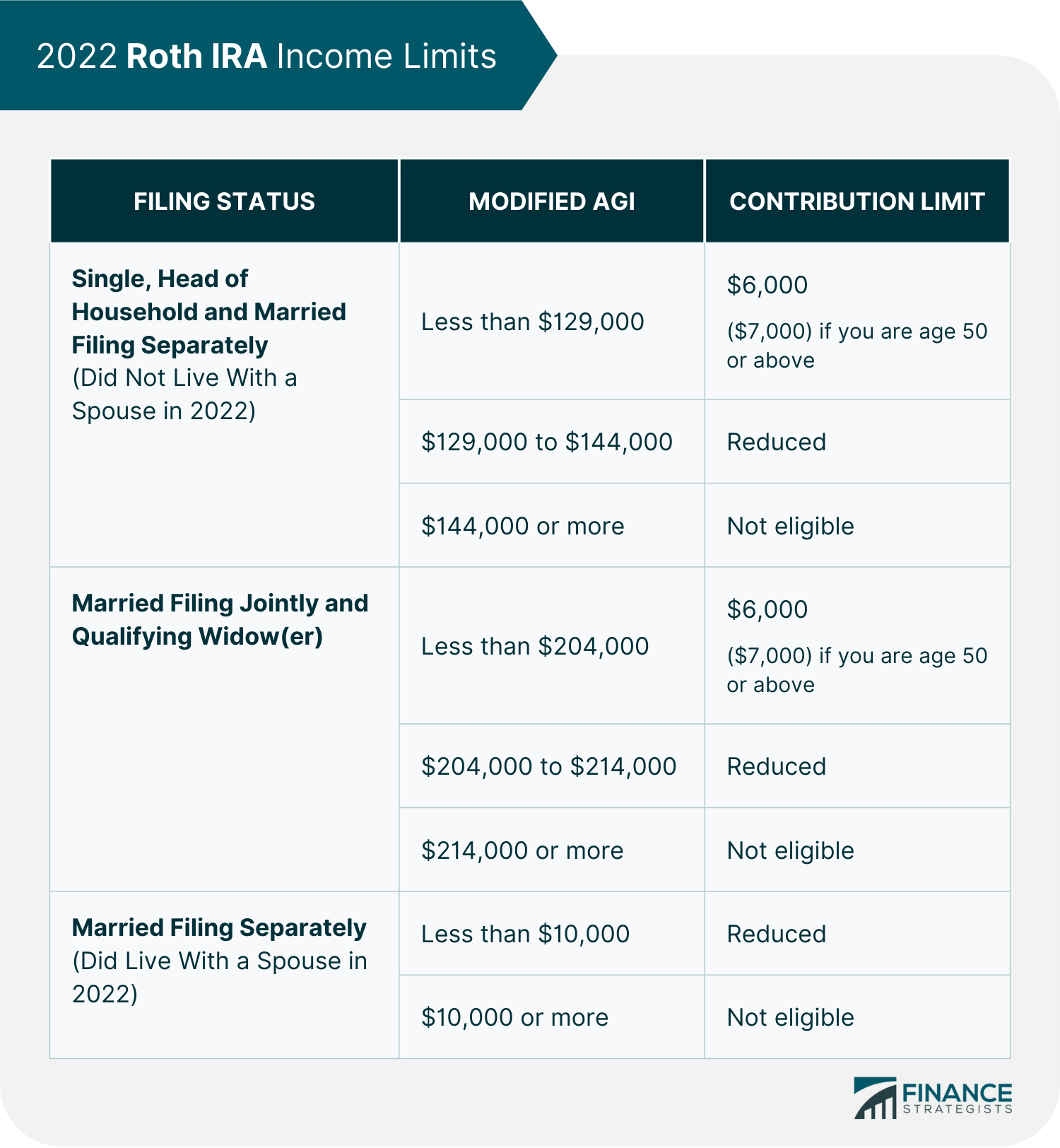

Whether you can contribute the full amount to a roth ira depends on your income.

2025 401k Roth Contribution Limits 2025 Ashlen Ludovika, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. 1, 2025, taxpayers can also make contributions toward their 2025 tax year limit until tax day in 2025.

Max Roth Ira Contributions 2025 Libbi Othella, Less than $146,000 if you are a single filer. $7,000 if you're younger than age 50.

Last Day For 2025 Roth Ira Mindy Sybille, Whether you can contribute the full amount to a roth ira depends on your income. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

Everything You Need To Know About Roth IRAs, You can also contribute the full $7,000 to a roth ira for 2025 before the tax filing deadline (april. For 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 or older.

If you are 50 or older, you can make an additional $1,000 contribution.